Barry's WSJ article is right. That AI stuff is going to go the way of the horse and buggy, just like that silly internet thing. As we all know, everyone lost their shirts forever in the dotcom bust. There are no surviving companies that actually made a profit off of internet activity, are there? I mean, it was all just hype, wasn't it?

Kidding aside, AI is merely a continuation of technological advancement. All the hype and consternation over it is nothing new. It happens every time something revolutionary comes along. There will be AI winners and losers, just like there were among the dotcoms. That's the nature of business and the nature of life.

On the flip side of that coin, I find it amusing to hear prognosticators talk about how AI is going to kill jobs. Even Elon Musk has jumped on that bandwagon, talking about how AI will create a world where no one has to have a job. Nuts! AI will create jobs we haven't even thought about yet, just like every technological advancement in the past. Many of the new jobs will go to those who learn to use AI in novel ways.

On a personal level, I love what AI can do. Among my many hobbies is trying to learn Spanish. I've been working at it for decades, with a very modest level of success. About a month ago, I signed up for an online service that allows me to converse in Spanish with an AI chatbot. I can actually talk with the thing! It corrects my grammar and offers feedback on my pronunciation and use of idioms. It's as good as any real, individual Spanish teacher, except that I can use it whenever and wherever I want to, and for as long or short a timeframe as I want. At my ripe old age, I'm learning faster than ever, and it's fun!

Original Message:

Sent: 06-01-2024 10:53

From: BARRY JOHNSON

Subject: Hype or Hope: How to Avoid Investing in the Next Big Nothing

Talk about timely.

6/1/24 WSJ posted this article, "The AI Revolution Is Already Losing Steam."

It provides 10 or so reasons that challenge the efficacy of all the AI hype from the same point of view that I raised. and it provides data that defines the contours of the models I outlined above.

Here is a Gift Link if you wish to read it.

https://www.wsj.com/tech/ai/the-ai-revolution-is-already-losing-steam-a93478b1?st=wy79ile9brgloe5&reflink=desktopwebshare_permalink

Here is a summary overview if you chose not to.

But significant disappointment may be on the horizon, both in terms of what AI can do, and the returns it will generate for investors.

1. New, competing AI models are popping up constantly

2. The rate of improvement for AIs is slowing.

3. There appear to be fewer AI applications than originally imagined for even the most capable of them.

4. AI is wildly expensive to build and run AI.

5. It takes a long time for AI models to have a meaningful impact on how most people actually work.

These factors raise questions about

6. spending on AI is probably getting ahead of itself as we last saw during the 1999-2000 fiber-optic boom that led to one of biggest crashes of the 2000-2001 dot-com bubble.

7. whether AI could become commoditized,

8. AI s potential to produce revenue and esp. profits, and

9. whether a new economy is actually being born.

------------------------------

BARRY JOHNSON

Original Message:

Sent: 05-30-2024 12:59

From: BARRY JOHNSON

Subject: Hype or Hope: How to Avoid Investing in the Next Big Nothing

Jeanna,

You seem to get all the good assignments.

I don't know very much and forget a lot of what I have learned.

A friend I taught with called this the "Cookie Tray Theory of Remembering." She said that every time you learn something new, you get a cookie added to the tray of cookies in your brain. Really smart folks, like engineers, know a lot and get a lot of cookies added to their tray. Their cookie tray gets very full fast. Sometime when you ask them a question that they know the answer to, they forget it because that cookie fell of their tray. That explains why really smart people forget some things they know.

Charlie Munger taught Warren Buffett that a person who can recall and use the most models usually produces better ideas because they cut through the hazy clouds of too much information. This is a process you can use to find your lost cookies.

You question made me remember I had learned a cookie one time called the Innovation Adoption Cycle also known as Rogers' Curve. In 1962, Everett Rogers of Ohio State University published the seminal work on the Diffusion of Innovations. Rogers synthesized research from over 508 diffusion studies across dozens of scientific fields. Rogers used his synthesis to produce the most widely accepted theory of the adoption of innovations among individuals and organizations.

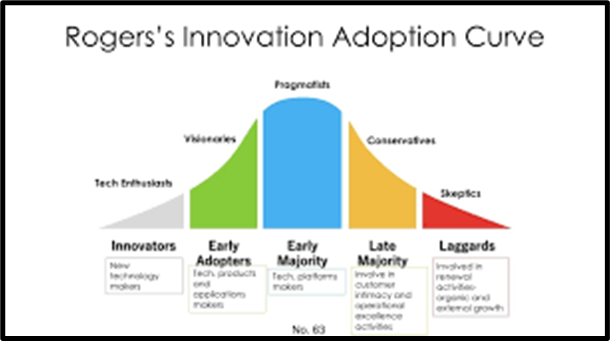

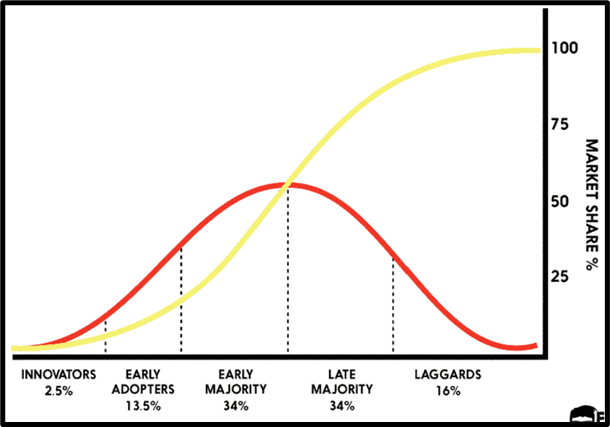

Rogers proposed that 5 main elements influence the spread of a new idea: 1) the attributes of innovation itself, 2) the rate adoption by users, 3) the communication channels used, 4) time, and 5) the efficiency of the social system. The innovation must be widely adopted in order to sustain itself. Within the rate of adoption, there is a point at which an innovation reaches critical mass. In 1989, Regis McKenna theorized that this point lies at the boundary between the stage 1 early adopters and the Stage 2 early majority (see illustrations). This is the gap between niche appeal and mass appeal (self-sustained adoption) called "the marketing chasm. Here are a two diagrams that explain the Rogers' Cycle.

This model helps us understand that innovation takes time and that the rate of adoption is a function of the bandwidth of the communication channels in our social system.

That makes me recall Claude Shannon's theory of communication. The Shannon–Weaver model is one of the first and most influential models of communication. Claude Shannon initially published the theory in a 1948 paper "A Mathematical Theory of Communication." He explained communication in terms of 5 basic components: 1) a source that produces the original message, 2) a transmitter that translates the message into a signal which is sent using a channel, 3) a channel, 4) a receiver that translates the signal back into the original message and makes it available to the destination, and 5) a destination.

Claude Shannon was a hugely interesting personality. At Bell Labs, where he did his research, he road unicycles down hallway. He has fascinated by the stock markets and amassed a legendary personal wealth through investing, but never told anyone, even his wife, what his secret was.

If Claude's ghost is channeling this blog, we may all learn his secret and we could become early adopters and use an AAII-recommend "buy and hold" long term strategy to know the answer Jenna is seeking.

Maybe Jenna already knows Shannon's secret and is breaking the adoption cycle on purpose.

I break all the AAI rules here. I read a lot all the time. Besides having many models to help me place new knowledge into the context of the appropriate model, I rely heavily on getting comparative data to understand the relative value of the new data. Shannon called this the "signal-to-noise ratio." Although we have access to a lot of communication channels, there is a lot of noise in every channel. As receivers in the chain of adopters, we need to understand our relative placement in the adoption cycle.

My opinion of the placement of AAIIers like me in this cycle is that Gene Fama's efficient market hypothesis model applies here. By the time AAIIers learn of any innovation, the early and early majority have already seized the largest part of the windfall profits. Think Magnificent Seven.

Our best leverage might be are persistence, patience, and willingness to take the "hindmost" profits over the long term. This is where the Cloonan Model clicks in.

That's my get rich slowly plan. 1) Read a lot. 2) Compare all the incoming data points. 3) Remember Mr. Market always has a head start. 4) Be patient. 5) Be Persistent. 6) Be not greedy. 7) Stay real. 8) Stay humble. 9) Thank The Lord for His blessings. 10) Enjoy our life. It's the only one you get.

Regards,

------------------------------

BARRY JOHNSON

------------------------------